In today’s fast-paced world, mastering financial management is crucial, leading to the creation of various platforms, tools, and apps to simplify life for everyone. Amidst this, Swipey offers a range of functions, providing users with a smart platform to navigate their finances with confidence. Among these, let’s delve into Merchant Control and its usefulness.

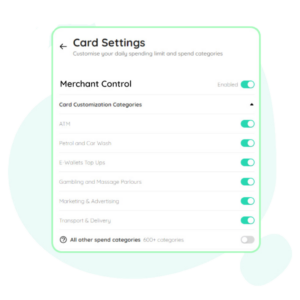

Different Categories for Different Cards

Merchant Control presents users with a practical feature – the ability to toggle various categories and spending limits for different cards with ease. Whether it’s for marketing, transportation, or others, admins can easily customize these settings based on specific needs or departmental requirements. This ensures purposeful spending, reducing the risk of accidental spending on unauthorized items.

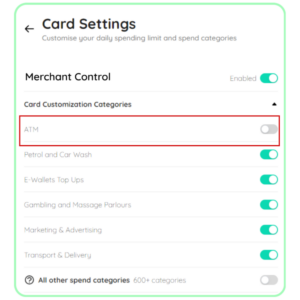

Turning On/Off ATM Withdrawals

In times when employees can withdraw cash, there might be instances that can lead to fund misuse, requiring the tracking down of expenses, which can be a headache. With Merchant Control, admins can turn it off when required, preventing unauthorized ATM withdrawals and the need for petty cash. This also encourages employees to think twice before resorting to cash transactions, reinforcing responsible spending habits.

Staying Within the Budget

With Swipey’s Merchant Control, fretting over misused funds or going over the budget becomes a thing of the past. Admins can set various cards for distinct categories and top-up a certain amount on each. For instance, upon completion of a campaign, the admin can also deactivate the marketing spend category on a designated card. This ensures that it won’t be misused, and you can rest assured knowing that the company’s financial well-being is a top priority.

Using It for Different Occasions

Recognizing the diversity in cultural and religious practices, Merchant Control enables users to adapt spending habits accordingly; let’s say, during during Ramadan or Hari Raya celebrations, users can allocate funds differently. For example, you can designate a specific card for buka puasa dining expenses during Ramadan and disable all other categories. This ensures hassle-free spending during special occasions without compromising financial goals.

Conclusion

In conclusion, Swipey empowers businesses to take control of finances with customizable spending categories, special occasion cards, and more. It also simplifies money management, redefining how companies engage with their finances, paving the way for a future of both security and growth.