Virtual cards are an increasingly popular payment solution for businesses of all sizes. These digital cards offer a range of benefits, including enhanced security, improved control over expenses, and the ability to make transactions online. In this blog, we will explore the top five ways that businesses can use them, and introduce Swipey, a leading virtual card provider that offers a range of features to help businesses manage their expenses more effectively from an all-in-one finance operating platform.

What is a Corporate Virtual Card?

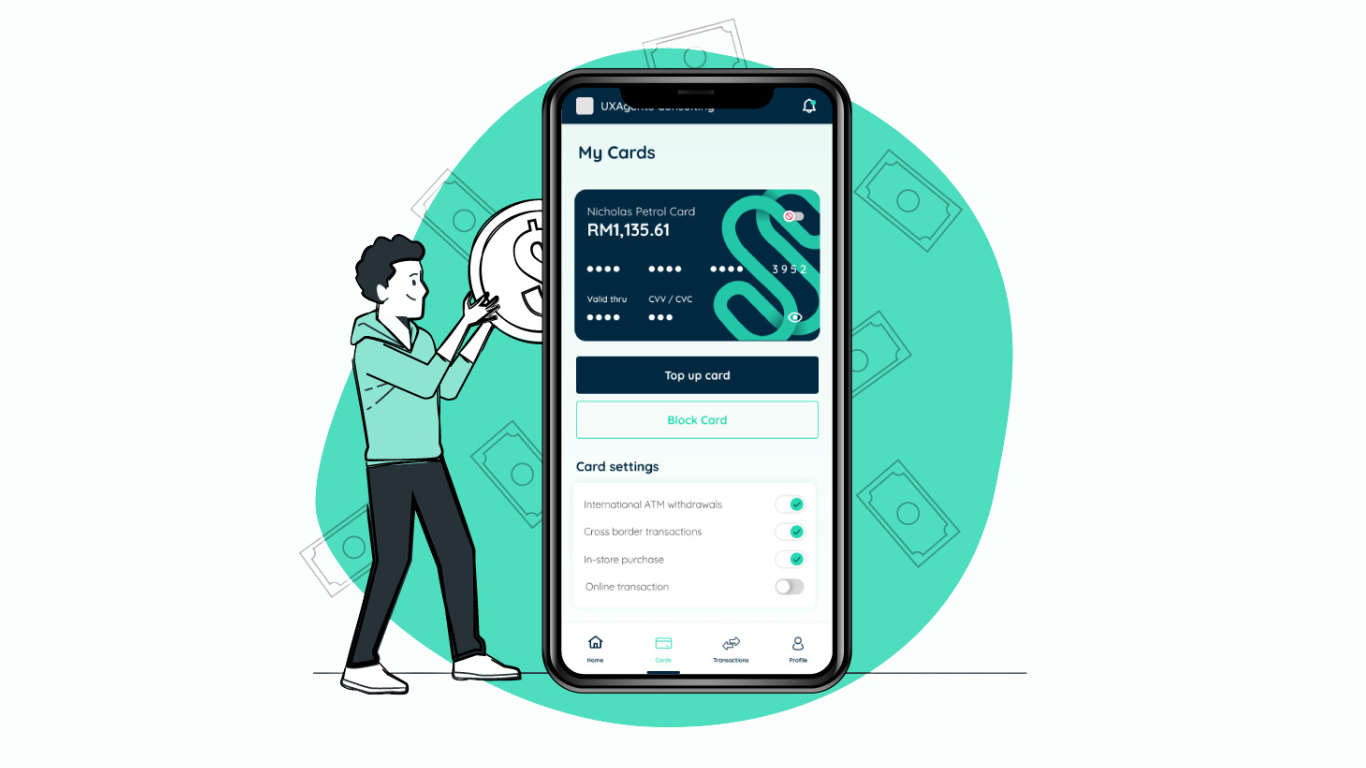

Businesses use corporate virtual cards as a digital payment solution to make purchases, pay bills, and manage expenses. Financial institutions issue these cards, which businesses can use for online purchases, subscriptions, and travel costs.

You can generate virtual cards based on the need to segregate spend or for limited periods, making them more secure than physical cards. These cards also provide businesses with greater control over their expenses, as they can set spending limits and track transactions in real-time.

How to Use Virtual Cards for Business

Online Purchases

One of the main advantages of virtual cards for businesses is the ability to make online purchases without the need for a physical card. Virtual cards also offer a higher level of security for online purchases.

Each virtual card generates a unique number for each transaction, reducing the risk of fraud and unauthorised transactions. With this added layer of security, businesses can confidently purchase supplies, services, and tools essential to their operations.

Subscription Services

Managing recurring payments for subscription services and software is virtually hassle-free with virtual cards. Businesses can generate and allocate cards based on needs for each subscription or a limited period, ensuring spending stays within budget. With the ability to set transaction limits and expiry dates, you can keep costs under control.

Travel Expenses

From flights to hotels and car rentals, virtual cards provide a convenient way for employees to handle travel-related expenses. It can be set up with spending limits, ensuring that employees do not overspend or make unauthorised purchases. Businesses can also track travel expenses in real-time, allowing them to manage their expenses more effectively.

Vendor Payments

Virtual cards offer a modern alternative to traditional payment methods for vendors. By issuing cards tailored to specific vendors or one-time transactions, businesses can secure their payments while maintaining clarity in their accounts. Spending limits and detailed tracking further ensure that vendor payments are both efficient and well-managed.

Employee Expenses

Admins can manage employee expenses such as meals, transportation, and supplies, with spending limits in place to ensure that employees adhere to the pre-set budget. Businesses can also monitor employee expenses in real-time, allowing them to manage their expenses responsibly.

Check out Swipey if you’re interested in using virtual cards for your business. We offer a range of tools to help businesses manage expenses more effectively, including enhanced security, improved control over expenses, and real-time transaction tracking. You can also watch Swipey’s short demo to learn more about Swipey’s financial operations system.

Discover how Swipey’s virtual cards can enhance your financial operations. Watch our demo or sign up today!