Happy holidays from everyone at Swipey!

As we close out 2025, we want to share how we’ve been working to solve the everyday hassles that slow finance teams down. This year wasn’t about cramming in more features. It was about removing the friction that shows up in your day-to-day: the manual work, the guesswork, the waiting around.

Here’s what we built.

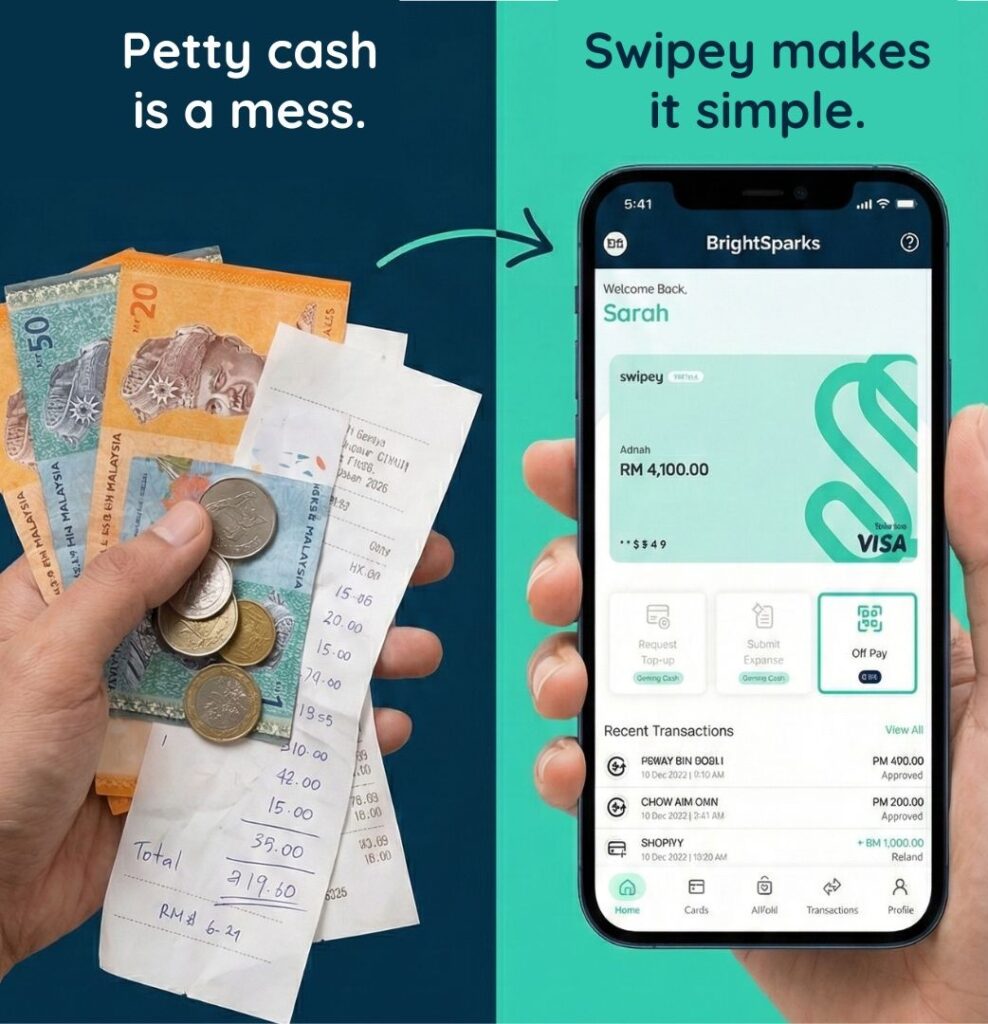

Bet #1: Kill the Cash Chaos

Cash creates two massive headaches for businesses:

Headache #1: Petty Cash Tracking

The traditional petty cash system is broken. Either you give employees cash upfront, then spend hours tracking who spent what, on what, with missing receipts or employees pay out of pocket first, then submit claims for reimbursement at month-end. Both options mean:

- Manual receipt collection

- Endless reconciliation

- Reimbursement delays

- Zero real-time visibility

Headache #2: Paying People Ad-Hoc

Need to pay your part-time contractor for a one-off job? Your freelance designer? That vendor who sends you an invoice?The current process invloves requesting their invoice, getting their bank account details, inserting payment details manually and following up to confirm they received it.It takes time. It requires admin effort. And it creates unnecessary back-and-forth.

We believed we could solve both problems with one simple solution: DuitNow QR integration directly in Swipey.

Say Goodbye to Petty Cash

Instead of handing out physical cash or making employees pay first, give your team digital petty cash through Swipey. When they need to pay for something:

- Scan the DuitNow QR code

- Pay instantly from their Swipey wallet

- Receipt captured automatically

No more envelopes. No more reimbursement forms. No more chasing receipts. No more month-end reconciliation nightmares.

Pay Anyone Effortlessly

Need to pay a part-time hire, contractor, or vendor for a one-off job?

- Ask them to send their DuitNow QR code

- Scan it in Swipey

- Pay them instantly without needing bank details, without waiting days

The payment is instant. The record is automatic. Reconciliation happens in real-time. And you’re done.

Two different cash headaches. One simple solution.

Bet #2: Speed Unlocks New Possibilities

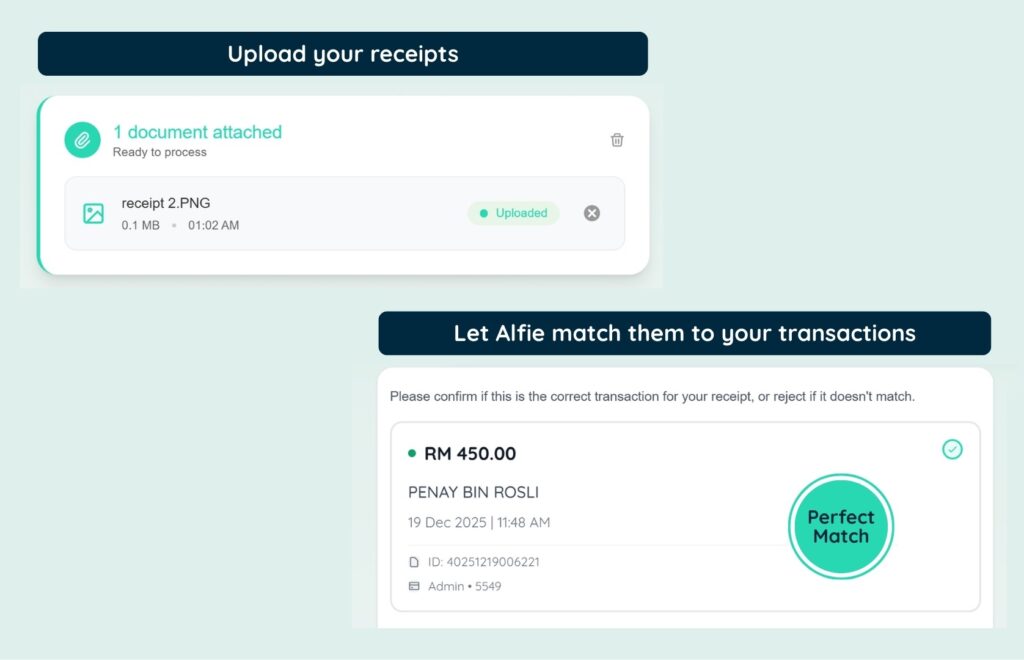

Time is money. But for most finance teams, month-end closing feels like time standing still. You’re manually matching receipts to transactions. Chasing employees for missing documentation. Copy-pasting data between systems. What should take a day stretches into a week.

We believed that with the right technology, we could compress weeks of work into hours. So we built two features designed for speed:

AI-Powered Receipt Matching

Your team makes a purchase. Swipey’s Alfie AI automatically matches the receipt to the transaction. No manual sorting. No guessing. Just instant, accurate reconciliation. Books that close up to 10× faster, with far fewer corrections and less follow-up.

Direct Accounting Integration

Once your transactions are ready, Swipey pushes them straight into your accounting system—QuickBooks or Xero. Your data flows in automatically. Categorized. Reconciled. Ready for your accountant to review.

Bet #3: Earn Points and Rewards While You’re At It.

Finance shouldn’t feel like pure overhead. So we asked a simple question:

What if everyday business spending worked for you?

Now, companies can run expenses through their credit cards including salaries, rent, and bills and earn points while doing it. Those everyday payments start stacking rewards instead of just draining budgets. A small perk, sure. But one that turns routine spending into something unexpectedly rewarding.

Here’s something that always bothered us: when businesses pay with personal credit cards, individuals earn the rewards. But the business is paying the bill. That never made sense. We believed business expenses should generate business rewards.Now when you run expenses through Swipey—whether it’s ad spend, SaaS subscriptions, rent, or bills—you earn points.Those points? They go straight back to your business. Use them for:

- Discounts on future transactions

- Cashback on company purchases

- Access to partner perks and benefits

Fund your Swipey account using your credit card to pay salaries, rent, and other vendors that don’t normally accept credit cards and still earn valuable points and rewards.Turn everyday business expenses into opportunities for rewards while using your line of credit to grow your business. It’s a strategic way to maximize your credit card benefits on payments you’re already making.

This isn’t just about points. It’s about making every ringgit work harder for your business. Over a year, those rewards add up—turning everyday expenses into something a bit more rewarding.

Everything We Shipped Came Back to One Question

What’s slowing you down — and how do we fix it?

Every update we shipped in 2025 came back to that question. And we’re just getting started.

Read the full 2025 release notes Step into 2026 with Swipey. Book demo!

Feature availability may vary based on account type, region, and regulatory requirements.