Most businesses don’t fail because of bad strategy. They fail because money becomes unclear and this tends to happen quietly.

- Expenses spread across personal cards and platforms.

- Receipts exist, but not in one system.

- Last year’s numbers are “mostly done,” but not final.

By March, when the business accelerates, this uncertainty becomes expensive. Your decisions start to feel cautious and forecasts feels like guesswork. This is when your confidence slips up. not because leaders lack judgment, but because the numbers aren’t solid.

January however, is different.

The year hasn’t fully picked up speed yet. There’s still room to pause and reflect. This makes January the ideal moment to build clarity — before it’s urgently needed.

From “We survived last year” to “We know where we stand”

Many teams enter January relieved rather than clear.

The year ends, targets are met, and momentum slows — briefly. But unresolved work doesn’t disappear. It carries over quietly into the new year, often unnoticed until decisions become harder to make.

This is the pattern that needs to change. The relief of closing the year is temporary, but the uncertainty that follows can linger well into the months ahead.

- Unfinished reconciliations roll over.

- Year-end expenses remain unreconciled.

- Receipts exist somewhere, but not in a system anyone fully trusts.

This isn’t a discipline issue. It’s a timing issue.

December is about closing deals, shipping work, and hitting targets — not cleaning up admin. The problem isn’t what happened last year. It’s carrying that uncertainty into the new one.

Why this becomes expensive

Without a clean baseline, every Q1 decision carries hidden risk:

- Budget planning relies on approximate numbers

- Cash flow projections include “we think” gaps

- Teams struggle to explain what actually worked last year

Over time, this forces leaders to choose caution over clarity — slowing decisions that should move faster.

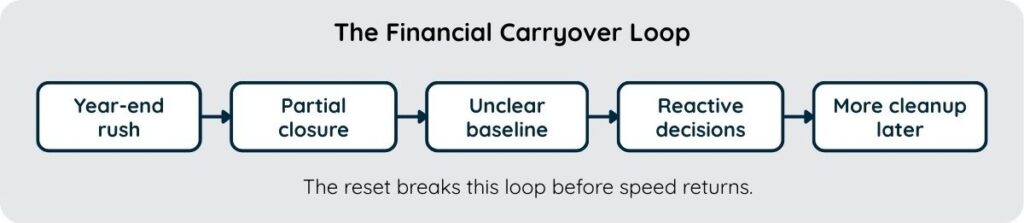

A simple way to think about financial carryover

For many growing teams, financial uncertainty doesn’t come from one big mistake.

It comes from a loop that quietly repeats every year.

January is the only point in the year where this loop can be interrupted calmly — before decisions, spending, and momentum accelerate again. The goal of a financial reset isn’t to fix everything. It’s to break the loop early by establishing visibility.

Knowing where your team stands

Strong teams don’t aim for perfect books in January. They aim for decision-ready clarity. That means:

- Knowing which balances are final and which are still in motion

- Having a visible list of unresolved expenses

- Trusting the numbers enough to plan forward with confidence

Clarity doesn’t require perfection. It just requires visibility.

Get clear: Surface what’s unresolved

Instead of trying to “clean up last year” all at once, treat January as a visibility checkpoint. Set aside 15 minutes and do three things, in order:

| Step 1: Surface what’s unresolved | List any expenses from December that are still unresolved (reimbursements, subscriptions, or payments) that haven’t been categorized yet. Don’t judge or fix them. Just surface them. |

| Step 2: Flag what’s missing | Note which expenses are missing receipts or supporting details. Group them by category rather than by individual transaction. Patterns matter more than precision at this stage. |

| Step 3: Mark what needs reconciliation | Identify which accounts still need reconciliation before the numbers can be trusted (bank accounts, cards, or wallets) that were used heavily at year-end. |

You’re not closing the books. You’re drawing a clear boundary between what’s known and what still needs attention. That distinction alone reduces uncertainty going into Q1.

From ‘reacting to spending’ to ‘understanding what drives the spending’

As teams grow, spending also start to drift. New tools are added one by one by different teams and operational costs expand quietly as these teams move faster. Not only that, one-off expenses start repeating until they feel normal.

Individually, none of these look alarming. Together, they create a situation where money moves faster than understanding.

When finance lacks visibility, teams stay reactive:

- Costs are reviewed after the month closes

- Variances are explained instead of anticipated

- Trade-offs are made with partial context

At that point, finance becomes more of a reporting function and not a decision-making one.

Why this becomes expensive

Without pattern awareness, cost control starts to feel random. Teams often:

- Cut what’s visible, not what’s impactful

- Miss the real drivers because they’re operational, not obvious

- Struggle to tell the difference between healthy growth and waste

This leads to hesitation. Leaders slow decisions not because they’re risk-averse, but because they’re unsure what levers actually matter. Over time, that uncertainty costs more than the spend itself.

Understanding what drives your spending

Strong teams don’t obsess over individual transactions. They move from transaction-level thinking to pattern-level thinking.

So, instead of asking: “What did we spend last month?” They ask: “What categories consistently drive our spending — and why?” That shift changes everything.

Pattern-level clarity allows teams to:

- Spot inefficiencies early, before they compound

- Predict pressure points before they show up in cash flow

- Make trade-offs deliberately, not emotionally

The goal isn’t to spend less at all costs. It’s to understand what’s driving spend well enough to decide where it makes sense.

Get smart: Understand your spending patterns

To regain clarity, don’t start with cutting costs. Start by understanding them.

| Step 1: Identify your top 3 categories | List your top three recurring cost categories — not individual vendors, but categories that repeat every month (e.g., marketing tools, cloud services, logistics). |

| Step 2: Track the trend | Look at how each category has changed over the past three months. You’re not hunting for precision. You’re looking for direction: stable, creeping, or accelerating. |

| Step 3: Label the type | Mark each category as either operationally driven (directly tied to activity or growth) or discretionary (adjustable without breaking momentum). |

This single exercise does more for decision quality than cutting random expenses — because it gives leaders context before they act.

From finance and operations ‘working separately’ to ‘moving together’

In growing businesses, operations move fast — because they have to. Spending usually happens close to execution while teams make decisions in real time as work needs to be kept moving.

Finance, meanwhile, often steps in later — reconciling, categorizing, and explaining what already happened. Everyone is doing their job, just not at the same time. The result isn’t failure. It’s separation. Over time, that separation creates friction:

- Operations feel slowed down by controls that arrive late

- Finance feels surprised by outcomes they didn’t see early

- Leadership sees results only after decisions are locked in

By the time the picture is clear, it’s already outdated.

Why this becomes expensive

The real cost isn’t the spending itself. It’s the lag between action and visibility. When finance identifies a problem:

- The budget has already been spent

- Explanations become defensive

- Corrections require reversals instead of prevention

This turns finance into a cleanup function and forces teams into reactive mode — fixing issues that could have been avoided with earlier visibility.

What teams working together looks like

High-functioning teams don’t choose between speed and control. They design systems where visibility keeps pace with execution. In these teams:

- Finance isn’t blocking operations

- Operations aren’t bypassing finance

- Both are working from the same picture early enough to act

The goal isn’t more oversight. It’s fewer surprises. When finance and operations move together, decisions feel lighter — because they’re informed, not rushed.

Get aligned: Move finance and ops together

Alignment doesn’t require a new process. It requires a rhythm. Introduce a lightweight weekly cadence between finance and operations. Keep it short and focused:

| What to do | What you’re learning | |

| Step 1 | Review forecast vs actual spend | Where are we this week? |

| Step 2 | Flag upcoming cost drivers | What’s coming next week? |

| Step 3 | Call out unusual signals | Anything unusual while it’s still small? |

This simple habit shifts finance from catching up to keeping pace and prevents cleanup from becoming the default.

But here’s where most teams get stuck: understanding what to do is one thing — making it automatic is another.

How growing Malaysian businesses actually implement this

The three resets above work — but only if they become repeatable, not one-time exercises. Most growing businesses don’t fail at understanding these steps. They fail at making them automatic. Manual processes tend to break down as the year gets busier, especially when teams change and responsibilities shift.

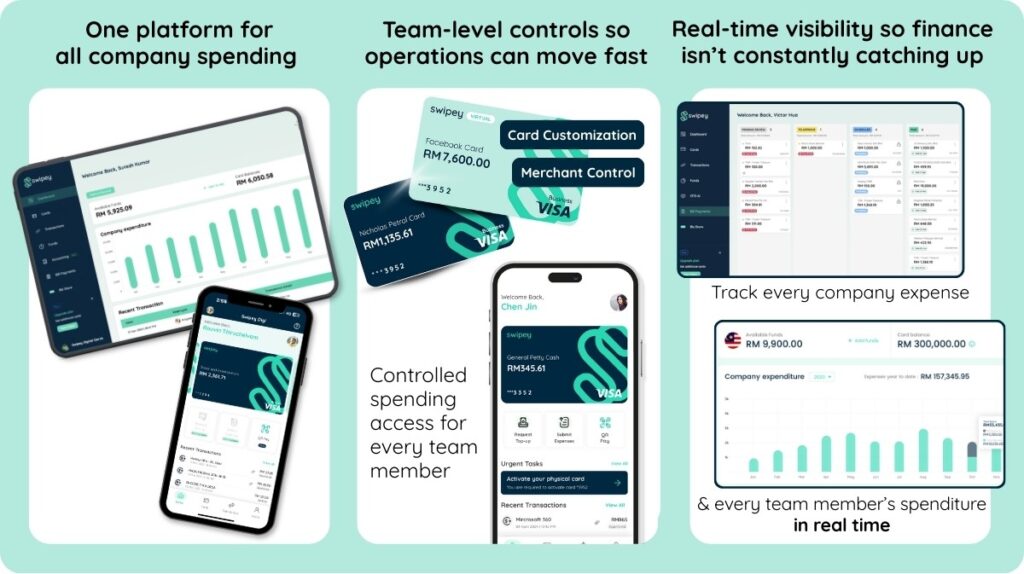

Swipey is designed to support this shift — giving growing teams consistent visibility even as operations and headcount evolve.

| Manual approach | With Swipey | |

| Get clear | Chase receipts across platforms. Build spreadsheets to track unresolved items. | Every transaction in one place. Missing receipts flagged automatically. |

| Get smart | Export data from multiple cards. Build pivot tables to find patterns. | Spending categorized by team and card in real-time. Patterns visible as they form. |

| Get aligned | Schedule weekly meetings just to ask “what did we spend?” | Operations spends with controlled cards. Finance sees everything live. No chase-down needed. |

For Malaysian businesses, this clarity that Swipey provides also makes EA Form preparation and LHDN processes far less painful later in the year.

This is what Swipey was built for

Not as another tool to manage but as the infrastructure that makes these resets automatic.

The reset still matters. But with the right infrastructure, it happens once — not every quarter.

If your team is ready to move from reactive to clear, see how Swipey gives you real-time visibility across cards, expenses, and operations.