Businesses run on payments but more often than not, it’s a complicated process. Whether it’s paying vendors, settling invoices, or handling payroll, it quietly drains time, money, and resources if done inefficiently. From dealing with bank charges for cross-border payments to managing rigid payroll systems, many businesses face financial bottlenecks they didn’t sign up for.

And the hidden costs are real. According to The Star, Malaysians could lose up to RM33 billion annually by 2029 in hidden forex charges alone.

That’s just one example of how outdated business finance methods are costing businesses more than they realise, the pinch is especially strong for growing businesses, where every ringgit counts. Let’s unpack where these inefficiencies come from, and how businesses can start doing things differently.

The Hidden Costs of Vendor Payments

Whether you’re paying for product sourcing, inventory management, logistics partners, or simply, your landlord, vendor payments are a regular part of your finance and management operations. But not all payment methods are created equal.

Local payments may seem simple—until you tally up the “small” fees charged for each transfer. Multiply those fees across dozens of monthly transactions, and suddenly it’s a line item on your P&L you can’t ignore.

International payments are even worse, with inflated exchange rates that eat into margins. Businesses usually face these challenges:

- Exchange rates that shift without warning

- Bank markups you only notice after the transfer is made

- Long settlement times that delay delivery or disrupt operations

And yet, these are accepted as the cost of doing business—but it doesn’t have to be this way.

When Payroll Isn’t Built for Flexibility

It’s well-known that traditional payroll systems and processes are falling behind, especially when workforce agility is now the norm. The lack of flexibility that comes with traditional payroll systems—that’s usually one-size-fits-all and built around full-timers—can cause issues for industries that rely on part-timers, freelancers, and contract workers like retail, marketing, and events.

Common challenges with traditional processes:

- Cash advances need to be tracked and reconciled

- Delays due to poor integration with accounting and management tools

- Lack of clarity around employee access and payment records

The solution isn’t more admin (that might lead to more human error!), it’s smarter processes. Businesses need the ability to disburse one-time payments efficiently, keep accurate records, and manage user access without compromising compliance. There’s a Swipey feature in the pipeline where you’ll be able to pay individuals through DuitNow QR soon.

Cutoff Times: The Small Detail That Causes Big Delays

Overlooking how important timing is when it comes to payment efficiency can cause serious process and vendor relationship issues. Everything may seem fine… until a salary misses the payroll cut-off, or a vendor chases an unpaid invoice that was technically sent but didn’t clear in time.

In 2021, 41% of buyers had late fees on vendor payments which was likely caused by data entry errors thanks to manual processes. An accumulation of this and it could spell bad news for businesses.

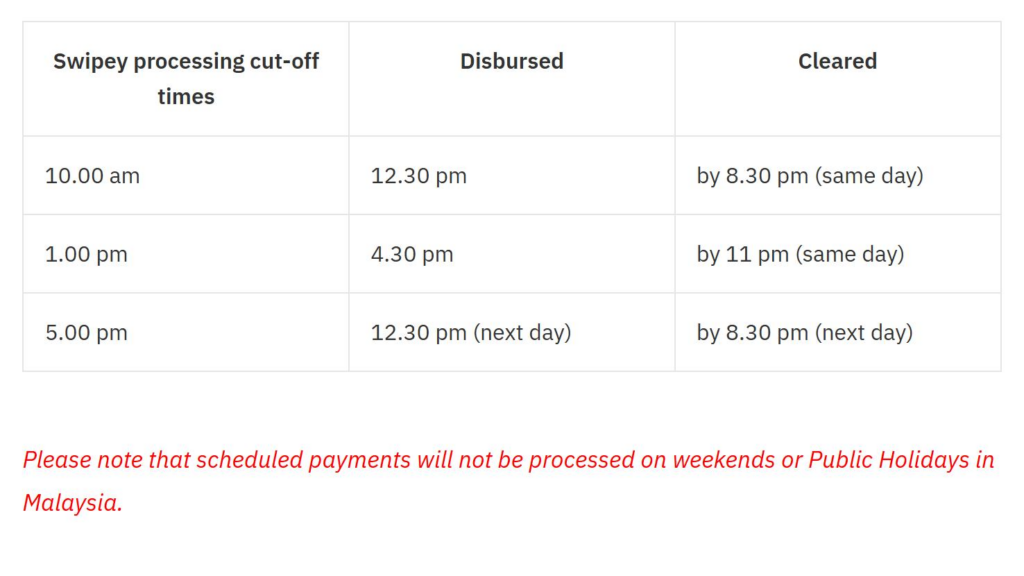

By aligning your payment schedule with clearly communicated processing times, your team can plan more effectively and avoid unnecessary follow-ups. And on that note, these are the cut-off times for when you submit your invoices and bills with Swipey.

The Swipey Advantage

Any forward-thinking business knows that optimising spend and payment processes isn’t just for convenience but also imperative to the growth of the company in the long run. But that doesn’t mean you have to get the latest or most expensive state-of-the-art finance platform or overhaul your finance stack. You can start by asking yourself these questions:

- Where are we losing money to fees or FX rates?

- How much admin time is spent on manual follow-ups and reconciliation?

- Are we giving our finance team the tools they need to be proactive instead of reactive?

Many have turned to Swipey for exactly these reasons. With seamless local payments, better FX rates for international vendors, and automated disbursements for bills and salaries, Swipey helps finance teams streamline operations, reduce costs, and regain full control and visibility.

Why More Businesses Are Switching

For businesses scaling sustainably, small inefficiencies compound quickly.

A delayed payment here, a hidden fee there—and before long, your finance team is stuck in a reactive loop. But with the right tools and processes in place, you can eliminate these friction points and let your team focus on what drives growth.

If your current finance process is costing more than it’s worth, maybe it’s time to try a smarter way.

Ready to optimise business payments? Join 2000 businesses using Swipey to save costs and streamline operations today. You can also book a demo to see how Swipey can fit into your current finance processes.