Many businesses dread the monthly task of handling bill payments. Finance teams across different industries face challenges like manual data entry, missed payments, and late fees, all of which slow down processes and drain resources. Fortunately, Swipey offers a comprehensive solution to streamline bill payments, providing businesses with a user-friendly platform and real-time insights to enhance efficiency across the board.

Here’s a Step-by-Step Approach to Get You Started:

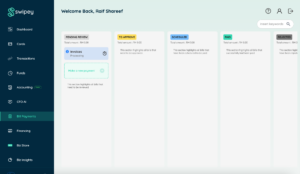

Step 1: Accessing Your Dashboard

Log in to your Swipey account and head over to the dashboard. From there, navigate to the bill payments section located in the left-side menu.

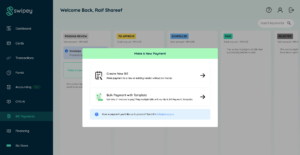

Step 2: Initiating Payments

Choose the option to make a new payment. You have the flexibility to create individual bills, set up bulk payments using templates, or conveniently email bills directly to bills@swipey.co. Swipey’s AI automatically extracts relevant information from the email and its attachments, populating the bill payment dashboard for you.

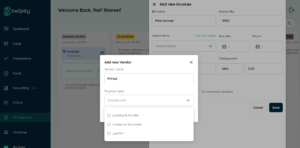

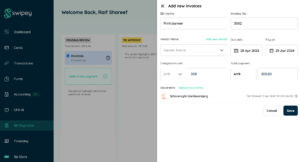

Step 3: Invoice Management

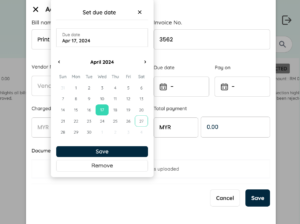

Add new invoices as needed and thoroughly review each invoice to ensure accuracy before approving it for payment.

Step 4: Automating Payments

Take advantage of Swipey’s automation features to schedule payments in advance, eliminating the need to manually process payments and reducing the risk of missed deadlines.

Beyond Automation of Bill Payments

- Scheduled Payments: Swipey allows you to schedule upcoming payments in advance, alleviating the stress of remembering due dates.

- Accounting Integration: Seamlessly integrate Swipey with popular accounting tools to further streamline processes and eliminate manual data entry.

- Consolidation is Key: Use Swipey to manage vendors outside of your bank’s network, consolidating all bill payments for improved control and efficiency.

- Security Measures: Rest assured that your financial data is secure with Swipey’s industry-standard security protocols. Establish clear approval workflows within your organization to ensure that only authorized personnel can review and approve payments before they are processed.

- Insights for Strategic Growth: Swipey offers more than just process optimization; it provides valuable insights into your spending habits and financial trends. Leverage Swipey’s categorization tools to track expenses by category, enabling better budgeting and financial reporting. Identify potential cost-saving opportunities and optimize your bill payment strategy for long-term success.

Optimising Your Bill Payment Journey: A Continuous Process

In the ever-evolving landscape of business, it’s essential to regularly review and update your bill payment processes. With Swipey as your trusted partner, you can transform bill payments from a burden into a strategic advantage. Free up valuable time and resources to focus on driving your business forward while Swipey handles the rest.